The Definitive Guide for Baron Tax & Accounting

The Definitive Guide for Baron Tax & Accounting

Blog Article

Baron Tax & Accounting Can Be Fun For Everyone

Table of ContentsWhat Does Baron Tax & Accounting Do?More About Baron Tax & AccountingThe smart Trick of Baron Tax & Accounting That Nobody is Talking AboutBaron Tax & Accounting - TruthsBaron Tax & Accounting for Beginners

Plus, bookkeepers are anticipated to have a respectable understanding of maths and have some experience in an administrative function. To become an accounting professional, you should contend the very least a bachelor's degree or, for a higher degree of authority and experience, you can come to be a public accountant. Accountants should additionally satisfy the rigorous needs of the bookkeeping code of method.

This makes sure Australian business owners get the finest feasible economic advice and management feasible. Throughout this blog, we have actually highlighted the large distinctions between bookkeepers and accountants, from training, to duties within your service.

Indicators on Baron Tax & Accounting You Should Know

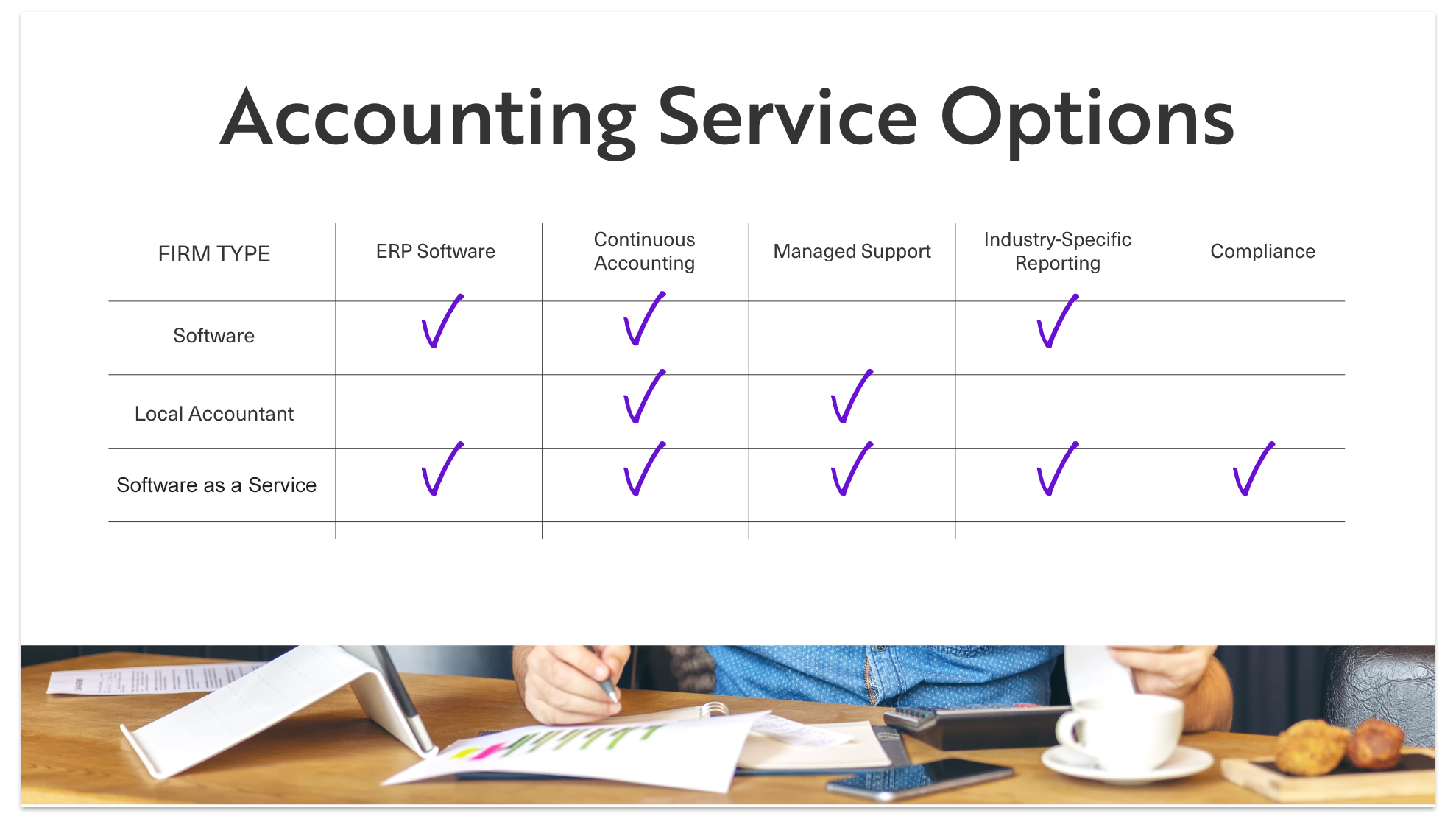

The solutions they give can maximize earnings and sustain your finances. Services and people should think about accountants an important aspect of monetary preparation. No bookkeeping firm uses every solution, so guarantee your experts are best fit to your specific needs.

(https://baronaccounting1.godaddysites.com/f/maximize-your-individual-tax-refund-australia-a-complete-guide)

Accountants exist to compute and upgrade the collection quantity of cash every worker obtains routinely. Remember that holidays and sicknesses influence payroll, so it's an aspect of business that you must regularly upgrade. Retired life is likewise a substantial aspect of payroll management, specifically provided that not every employee will certainly wish to be enlisted or be eligible for your business's retired life matching.

Baron Tax & Accounting - The Facts

Some lenders and investors require definitive, tactical choices in between the organization and investors following the click over here now meeting. Accountants can likewise be present here to aid in the decision-making procedure.

Local business usually face unique financial challenges, which is where accounting professionals can give invaluable assistance. Accountants offer a variety of services that help businesses remain on top of their finances and make informed decisions. Accounting professionals likewise ensure that organizations abide by financial policies, taking full advantage of tax cost savings and reducing mistakes in financial documents.

Accountants ensure that workers are paid precisely and on time. They determine payroll taxes, manage withholdings, and make certain compliance with governmental policies. Processing paychecks Taking care of tax filings and payments Tracking employee benefits and reductions Preparing pay-roll reports Proper payroll management prevents problems such as late repayments, incorrect tax filings, and non-compliance with labor laws.

Everything about Baron Tax & Accounting

This action reduces the danger of errors and possible penalties. Small company proprietors can depend on their accounting professionals to manage complex tax obligation codes and regulations, making the filing procedure smoother and much more effective. Tax obligation planning is one more necessary solution given by accounting professionals. Efficient tax preparation entails planning throughout the year to decrease tax obligation responsibilities.

Accounting professionals help tiny businesses in determining the well worth of the company. Techniques like,, and are utilized. Exact evaluation assists with marketing the service, safeguarding loans, or drawing in investors.

Describe the process and answer inquiries. Repair any discrepancies in records. Guide organization owners on finest methods. Audit support assists businesses go via audits smoothly and efficiently. It decreases tension and errors, making certain that services meet all essential guidelines. Legal conformity entails sticking to legislations and regulations connected to service procedures.

By establishing sensible monetary targets, organizations can allot sources efficiently. Accountants overview in the application of these strategies to guarantee they straighten with business's vision. They often examine strategies to adapt to altering market conditions or service growth. Threat management entails determining, assessing, and mitigating threats that might affect an organization.

Getting The Baron Tax & Accounting To Work

They aid in setting up inner controls to avoid fraud and errors. In addition, accountants suggest on conformity with legal and regulatory needs. They ensure that organizations follow tax laws and sector regulations to avoid charges. Accounting professionals additionally advise insurance policies that use defense versus possible dangers, making certain business is protected versus unforeseen events.

These tools assist small businesses keep precise documents and simplify procedures. is applauded for its extensive attributes. It aids with invoicing, payroll, and tax prep work. For a complimentary alternative, is suggested. It supplies numerous attributes at no charge and appropriates for startups and small companies. stands out for simplicity of use.

Report this page